Alibaba Group Holding Limited (NYSE:BABA) is reportedly launching an Amazon (NASDAQ:AMZN) like voice controlled speaker this week that is capable of taking orders in Chinese.

According to media reports, Alibaba’s artificial intelligence research teams have been developing this device that will be launched exclusively in China and allow domestic customers to order from the company’s website. That means the device won’t be hitting the U.S. market.

Another Example of Alibaba Following Amazon

In addition to the core e-commerce business, Alibaba has been getting involved into ventures that are similar to that of Amazon. From its offline push and blending online and offline features in retail to movies, cloud and artificial intelligence, Alibaba has been doing exactly what Amazon does in the U.S. If the recent reports are true, the move will just be another of Alibaba’s efforts to go the Amazon way.

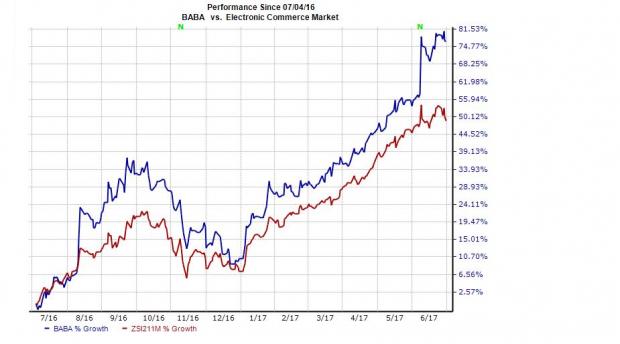

Investors will surely keep an eye on how Alibaba’s efforts beyond online retail impact its share price, especially when it has appreciated a massive 76.9% over the last one year compared with the Zacks Electronic Commerce industry’s gain of 48.9%.

We see this “Follow Amazon” strategy of as an intelligent move to create strong entry barriers for the likes of Amazon. The company is trying to block all doors through which rivals can manage entry into China.

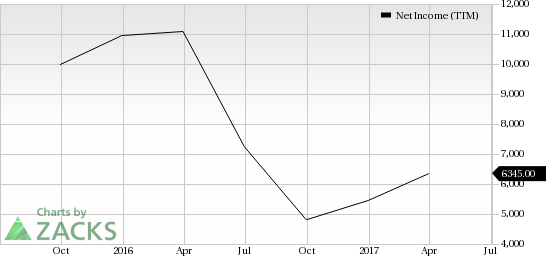

Alibaba Group Holding Limited Net Income (TTM)

The Growing Significance of Artificial Intelligence

Alibaba’s ability to innovate has translated into strong growth for the company. The company’s speed and scale of technological improvements clearly indicate that it refuses to rest on its past laurels and continues to adapt to changing market trends.

It appears that like other tech companies such as Alphabet (NASDAQ:GOOGL) , eBay (NASDAQ:EBAY) , Apple (NASDAQ:AAPL) and Amazon, Alibaba too is banking on artificial intelligence and machine learning for much of its future growth.

To Conclude

The once nascent smart home market is already a potential area of growth, thanks to Amazon and Google.

Now, it remains to be seen how Alibaba could further disrupt the industry. A successful device strategy could not only attract more customers to its websites but also help it penetrate potential business areas through third party contracts.

Alibaba currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research